Tax Planning Strategies

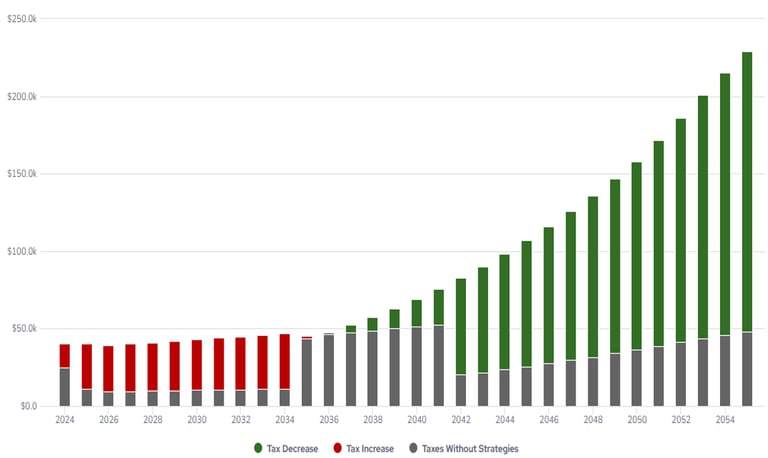

At Murano Wealth Management, we take a proactive, strategy-driven approach to tax planning. Our goal is simple: aim to reduce tax drag through efficient strategies by aligning your investments with smart tax-efficient techniques tailored to your financial journey.

Tax planning is not just a year-end activity, it is a year-round strategy. We integrate tax efficiency into every stage of your financial planning process.

Our goal is to close the "tax gap". Oftentimes there is a lack of proactive tax planning in which clients receive. Generally, tax preparers are focused on the backwards oriented process of filing a tax return for the past year and investment managers oftentimes do not integrate tax planning into their offering.

At Murano Wealth Management, we bridge that gap by offering forward-looking, integrated tax strategies designed to grow and protect your wealth. By combining proactive tax planning with personalized investment guidance, we help identify and evaluate tax-saving opportunities.

Roth IRA Funding

Navigate contribution limits and leverage after-tax contributions to maximize Roth investing aiming to create a tax-free future

Asset Location

Align your asset types with the right account structures (taxable, tax-deferred, tax-free) aiming to improve after-tax returns

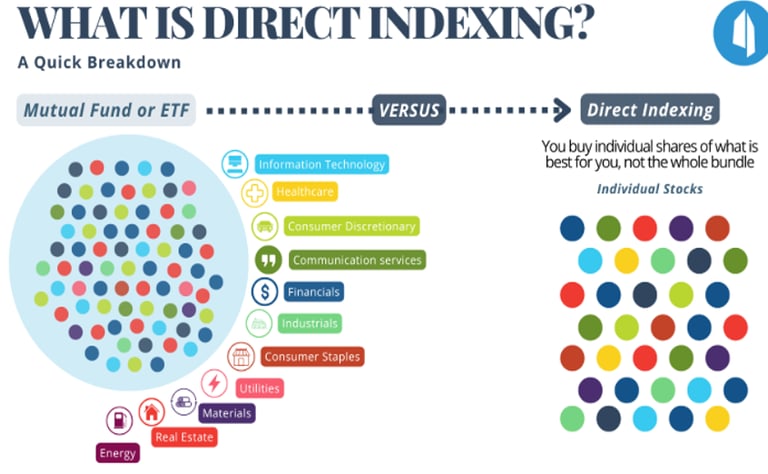

Customized index exposure with tax-loss harvesting to create a personalized, tax-smart portfolio. By owning equities at the individual stock level you can tax-loss harvest on the stock level not just the ETF level

Direct Indexing

Roth Conversions

Convert assets from Traditional IRAs to Roth IRAs to create future tax-free income—optimized around your income curve

Contact

646-655-9450

gmurano@muranowealth.com